The Emergence and Impact of Online Investment Platforms

Online investment platforms have significantly altered the landscape of personal and institutional investing. The digital age has democratized access to financial markets, enabling a broader audience to invest with greater ease and lower costs.

This article explores the evolution, features, benefits, challenges, and future prospects of online investment platforms.

Evolution of Online Investment Platforms

The advent of the internet in the late 20th century laid the groundwork for online investment platforms. Initially, these platforms offered basic functionalities such as buying and selling stocks. However, as technology advanced, they expanded to include a wide array of financial instruments such as mutual funds, ETFs (Exchange-Traded Funds), bonds, and even real estate.

The dot-com boom of the late 1990s and early 2000s was a pivotal period that saw the rise of discount brokers like E*TRADE and TD Ameritrade. These platforms leveraged the internet to offer lower fees compared to traditional brokers, making investing more accessible to the average person. The subsequent development of fintech innovations has further transformed the industry, introducing robo-advisors and algorithmic trading.

Features and Benefits of Online Investment Platforms

Online investment platforms offer numerous features designed to enhance the investment experience. Some of the key features and benefits include:

- Accessibility: One of the most significant advantages of online investment platforms is their accessibility. Anyone with an internet connection can open an account and start investing, breaking down barriers that previously restricted market access.

- Lower Costs: By eliminating the need for physical branches and reducing overhead costs, online platforms can offer lower fees and commissions. This cost-efficiency benefits investors by allowing them to keep more of their returns.

- Diverse Investment Options: These platforms provide access to a wide range of investment products, from stocks and bonds to mutual funds, ETFs, and real estate. This diversity allows investors to build well-rounded portfolios tailored to their risk tolerance and financial goals.

- Convenience: Online platforms enable investors to manage their portfolios from anywhere at any time. The ability to monitor investments, execute trades, and access financial information on-the-go is particularly valuable in today’s fast-paced world.

- Educational Resources: Many platforms offer educational tools and resources such as articles, videos, webinars, and tutorials. These resources empower investors to make informed decisions and improve their investment knowledge and skills.

- Automated Investing: The rise of robo-advisors has brought automated, algorithm-driven financial planning services to the masses. These services offer personalized investment strategies based on individual goals and risk tolerance, often at a fraction of the cost of traditional financial advisors.

Challenges and Risks

Despite their many advantages, online investment platforms are not without challenges and risks. Key concerns include:

- Cybersecurity: The digital nature of these platforms makes them susceptible to cyberattacks. Ensuring robust cybersecurity measures to protect user data and prevent unauthorized access is crucial.

- Market Volatility: The ease of access to investing can sometimes lead to impulsive decisions driven by market volatility. Investors, particularly novices, may react emotionally to market swings, resulting in poor investment choices.

- Regulatory Environment: The rapid evolution of online investment platforms has often outpaced regulatory frameworks. Ensuring that these platforms adhere to regulations and protect investors is an ongoing challenge for regulators worldwide.

- Technical Issues: Online platforms can experience technical glitches or downtime, which can prevent investors from executing trades or accessing their accounts. Such issues can lead to missed opportunities or unintended financial losses.

- Information Overload: The vast amount of information available on online platforms can be overwhelming for some investors. Filtering out noise and focusing on relevant data is essential for making informed decisions.

Impact on the Investment Landscape

The proliferation of online investment platforms has had a profound impact on the investment landscape. Some of the most notable changes include:

- Increased Market Participation: By lowering barriers to entry, online platforms have enabled more people to participate in financial markets. This increased participation has introduced new dynamics into the market, including higher trading volumes and greater market liquidity.

- Transparency and Efficiency: Online platforms have enhanced transparency by providing real-time access to market data and investment information. This increased transparency has led to greater market efficiency and improved investor confidence.

- Personalized Investing: The advent of robo-advisors and AI-driven investment tools has enabled personalized investing at scale. Investors can now receive tailored investment advice and strategies based on their unique financial goals and risk profiles.

- Shift in Financial Advisory Services: The rise of automated investing has disrupted traditional financial advisory services. While human advisors still play a crucial role, particularly for high-net-worth individuals and complex financial situations, robo-advisors have made professional investment advice more accessible and affordable for the average investor.

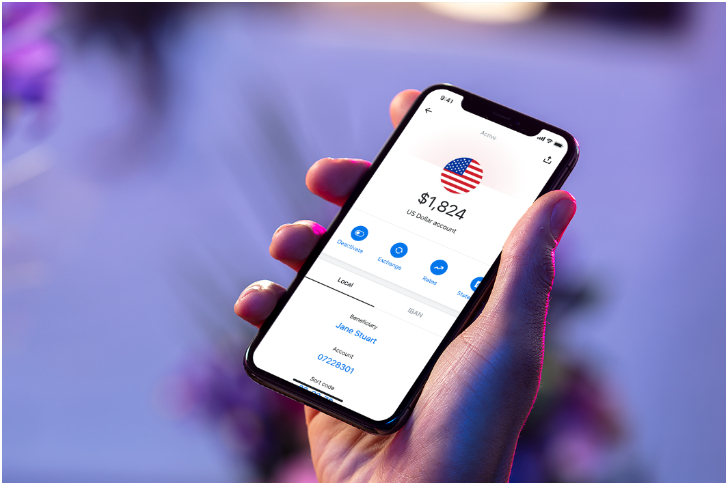

The Role of Mobile Investment Apps

The proliferation of smartphones has further revolutionized investing by introducing mobile investment apps. These apps offer the same functionalities as their web-based counterparts, with the added convenience of mobile access. Mobile apps have become particularly popular among younger investors, who value the ability to manage their investments from their handheld devices.

Mobile investment apps often come with user-friendly interfaces and push notifications that keep investors informed about market movements and portfolio performance in real time. This ease of use and accessibility have attracted a new generation of investors, contributing to the ongoing democratization of investing.

Future Prospects

The future of online investment platforms looks promising, with several trends likely to shape the industry. These include:

- Artificial Intelligence and Machine Learning: AI and machine learning technologies are poised to revolutionize investing by offering predictive analytics, personalized investment strategies, and enhanced risk management tools. These advancements will help investors make more informed decisions and improve their overall performance.

- Blockchain Technology: The integration of blockchain technology into investment platforms can enhance transparency, security, and efficiency. Blockchain’s decentralized nature can help reduce the risk of fraud and improve the integrity of financial transactions.

- Social Investing: Social investing platforms allow users to follow and mimic the investment strategies of experienced investors. This community-driven approach can help novice investors learn from experts and improve their investment skills. The rise of social investing is expected to foster a more collaborative investing environment.

- Regulatory Evolution: As online investing continues to grow, regulators will need to adapt to ensure fair practices and protect investors. This may involve developing new frameworks to address emerging challenges and leveraging technology to enhance regulatory oversight.

- Customization and Personalization: Future investment platforms are likely to offer more customization options, allowing users to tailor their investing experience to their individual preferences. This could include personalized dashboards, customized alerts, and tailored educational content.

Conclusion

Online investment platforms have transformed the way people invest, making it more accessible, cost-effective, and convenient. By providing a diverse range of investment options, educational resources, and automated investing services, these platforms have empowered a new generation of investors. However, the rapid growth of online investing also brings challenges, including cybersecurity risks, market volatility, and regulatory concerns. As the industry continues to evolve, the integration of advanced technologies and the development of robust regulatory frameworks will be crucial in ensuring the sustainability and integrity of online investing. With ongoing innovation and adaptation, online investment platforms are set to play an increasingly important role in the global financial ecosystem.

Recent Comments